[This post also appears on the Yankee Group blog at blogs.yankeegroup.com]

I've been tuning into the Apple earnings call, and have been amazed at how well they are weathering the current economic downturn (compare their results with Nokia's and you'll see what I mean). But on that call, I just heard one of the odder things I can remember, namely that revenue recognition for iPhones sold after March 17, 2009 will be deferred until the iPhone 3.0 software f is released. Let me say that again in a different way: From the point of view of its business accounting, Apple won't consider the iPhone 3Gs shipped to customers since March 17 sold until iPhone 3.0 comes out. For any normal hardware business, that would be highly unusual. For a consumer electronics company that lives on tiny margins, that's just crazy talk.

What I find simply astonishing is that none of the financial analysts are asking questions about this strange policy; they're doing their usual drilling down into the details of how the margins and ASPs of all the products have changed. But to me, the big news here is hiding right in plain sight: Apple expects iPhone 3.0 to have a big affect on its business results going forward. And three months from now, I expect people will be asking themselves how they missed it.

I said in my recent report that Apple is reinventing the mobile phone business by creating Anywhere experiences. I think Apple just told the financial analysts that it doesn't intend to rest on its laurels.

FOLLOWUP: Yankee Group director Josh Holbrook here noted that I had missed the fact that Apple did this last year as well with iPhone 2.0. Another commenter noted that Apple only moved the revenue from about 500,000 iPhones (the ones sold between March 17 and the end of the quarter) into the next quarter or two, resulting in only a few million dollars of revenue moved. All true.

But the reason that this has piqued my interest is that Apple already defers the majority of revenue on iPhones by spreading out the purchase price over 24 months. The reason it has given for this practice is to allow it to provide free upgrades. So why does Apple now feel it necessary to further defer revenue, when it already has an accounting model in place to deal with this issue?

Perhaps my befuddlement will make more sense if I ask a slightly different but related question: How many companies hit by the recession are trying to defer reporting revenue and profit they have already delivered on?

At the moment, I only know of one of them.

Search This Blog

Thursday, April 23, 2009

Apple deferring iPhone sales revenue? Heresy!

Posted by

Carl Howe

at

8:07 AM

1 comments

![]()

![]()

Labels:

Anywhere experiences,

Apple,

consumer electronics,

iPhone

Wednesday, December 17, 2008

Apple pulls out of Macworld! And floppy disks are gone too!

The blogosphere is aflutter with the news that this year will be Apple's last Macworld event and that Phil Schiller rather than Steve Jobs will be doing the keynote. What could have gone wrong? Is Steve ill? Does this mean the end of Apple?

Get a grip people. The real reasons behind this move are exactly what the press release says (gasp! can you do that in PR?). Macworld, like most other trade shows, wasn't really working as part of Apple's marketing strategy, so they gave notice that they aren't going to do it any more. The reasons? It's actually pretty simple. Apple's annual Macworld extravaganza was:

- Expensive. Macworld Conference and Expo may be a cultural icon to some, but it is actually just a trade show organized by IDG. While that is a great business for IDG, it's a multi-million dollar expense for Apple, all to reach around 50,000 attendees. While that may be nice, it's about the same number of people Apple reaches at its Fifth Avenue Store in New York in a few days. Not exactly the best return on investment.

- Inconvenient. Let's see, what's the best way to annoy employees? I know, we'll make them work through the holidays to prepare for a big trade show on the first week of the new year. While all of the consumer electronics industry seems to honor this tradition for the January Consumer Electronics Show, that doesn't mean it's a good practice. Apple and its employees don't need the hassle.

- Way too predictable. There's no better way to ruin surprise and excitement than to schedule it months in advance (proof point: Microsoft OS launches). Pundits everywhere (myself included) now plan stories and research around the first week in January knowing that Apple must have something new to talk about. That doesn't fit with the amazingly great marketing Apple likes to produce. And yet the downsides of this predictability are huge: if the unthinkable should happen -- some technology is late, there's a new product production glitch -- Apple has to jump through hoops to deliver regardless or be painted as having "failed" because they didn't deliver in time for Macworld.

The bottom line: Apple has again figured out yet another way to "think different" by leaving something out, just as it did with the floppy disk. And just as with floppies, the rest of the industry will go through denial, rejection, and finally acceptance that it was the obvious thing to do. 2009 is already shaping up to be a very interesting year.

Posted by

Carl Howe

at

11:37 AM

5

comments

![]()

![]()

Labels:

Apple,

Macworld,

marketing,

Steve jobs

Tuesday, October 28, 2008

Impressive analysis of Apple's current earnings

Bullish Cross has a very nice analysis of Apple's current earnings if you don't do subscription accounting for iPhones. The bottom line: if you turn off subscription accounting, the company is making about $7.50 a share and has a P/E of about 12. As noted in the article, Apple has more net cash than RIMM, GOOG, AMZN, and IBM combined. If it were valued at their P/Es, Apple's stock would be trading around $200.... But in my humble opinion, the financial crisis has encourage a "throw the baby out with the bathwater" mentality, hence the stock's current pricing. It's a delightful analysis; Apple watchers should give it a read, if for no other reason than the eye-popping nuggets of financial information.

Posted by

Carl Howe

at

10:37 AM

0

comments

![]()

![]()

Labels:

Apple,

financial analysis

Monday, July 14, 2008

Activation problems don't stop iPhone from being largest CE launch in history

[This post also appears on blogs.yankeegroup.com]

[This post also appears on blogs.yankeegroup.com]

Josh Martin beat me to the punch with his post on the Apple press release this morning (curse you!), but I thought I'd add a bit more context to the story.

Those one million iPhone 3Gs sold this weekend provide a pretty good clue for why Apple and AT&T's activation servers are slammed and barely able to keep up. This was a big deal. Why? Because not only was it about 4 times more phones than Apple had to deal with last year at this time, but because it is probably the largest consumer electronics launch in history.

I noted when I was analyzing Apple at my prior company, the original 2007 iPhone launch was the largest first weekend consumer electronics launch in history as measured in inflation-adjusted dollars, garnering somewhere around $150 million in its first weekend on sale. That eclipsed the Microsoft XBox 360 ($128 million in the first weekend), Microsoft Windows 95 ($122 million in the first four days), and the Sony Betamax (not even close at $58 million in the first 7 months). But Apple just broke its own record. Assuming an average price after carrier subsidy of $433 (2/3 8 GByte models, 1/3 16 GByte models), Apple just posted approximately $433 million in first weekend iPhone sales. Said another way, if this had been a movie, it would have broken all box office records for a first weekend opening -- by a factor of nearly 3.

And the AppStore? That's harder to get a handle on. My estimate is that most of those downloads were free programs, and that Apple pulled in somewhere around $3.5 million in AppStore revenue, of which it got to keep just about $1 million (the other $2.5 million went to the pay application developers). But again, for a first weekend launch, that isn't too shabby -- it took the original iTunes store a week to reach the $1 million mark in revenue in 2003.

Now some will ask why we're gushing about the iPhone -- after all, it's just a phone. But from my personal point of view, it's important for a very specific reason: it's an Anywhere phone. What's an Anywhere phone? One that provides first-class, two-way, broadband access to both the world-wide voice and Internet networks. Most phones have been first class phones and second-class Internet devices; the iPhone has changed that, and done it in such a way that even my technology-phobic mother could use one. We shouldn't be surprised when good technology gets a good reception.

Yes, there were a lot of server and activation problems this weekend, and both Apple and its carrier partners should get their acts together. But making history is never easy or smooth. And Apple's competitors should be happy about the problems they had. Imagine how many iPhone 3Gs Apple would have sold if the launch had been problem-free.

Posted by

Carl Howe

at

11:26 AM

2

comments

![]()

![]()

Labels:

3G,

Anywhere phone,

Apple,

AppStore,

business results,

iPhone,

itunes,

revenue

Monday, July 7, 2008

Call the Centers for Disease Control! iPhone epidemic expected!

sn't it amazing that some people can tell a week in advance when they are going to be sick? If you're one of those people who senses that the 24-hour iPhone flu is going to wrack your body starting next Thursday, you should be sure to read these iPhone 3G Sick Day Tips. Oh, and remember that if you call in sick and stand in line at the Boylston St. Apple store, we can see you. Meanwhile, Happy Fourth of July America; happy weekend to everyone else. And by the way, if you think the above is crazy, note that people are already camping out in line at the New York 5th Avenue Apple Store.

Posted by

Carl Howe

at

11:06 AM

0

comments

![]()

![]()

Thursday, June 12, 2008

Apple's iPhone 3G: who needs carrier subsidies?

[This post also appears on the Yankee Group Blog at http://blogs.yankeegroup.com] With Apple's iPhone launching on July 11 for $199 in the US with a 2-year AT&T contract, everyone (including me) is assuming that there's a roughly $200 AT&T subsidy baked into that price. That assumption seems especially reasonable since AT&T is raising its unlimited data service subscription price by $10 per month and will no longer share subscription revenue with Apple. Those two factors means that AT&T is accruing about $480 more ($240 from the higher data service price and $240 from not sharing subscription revenue with Apple) per 3G subscriber over the two-year contract, leaving them plenty of room to pay Apple roughly $399 up front for 3G iPhones and still sell them to consumers for $199. But there's an intriguing twist to this story that may surprise people. According to Porteligent and as reported by EETimes, the parts cost of the 3G iPhone may be as low as $100. That means that even at $199, Apple's price includes a roughly 50% gross margin over its parts cost, which is in the ballpark of the gross margins on traditional iPods. If AT&T is adding in a $200 subsidy, then the iPhone 3G is anything but a a phone requiring a carrier subsidy. In fact, if these numbers are true and the carriers are subsidizing the phone, the iPhone 3G could end up being the most profitable product Apple makes. But more likely, this means that Apple has a lot more pricing flexibility than analysts have given them credit for. Now as one of those analysts, I have to apply a caveat here. It's highly unlikely that Portelligent actually has an iPhone 3G to tear down, so their parts cost analysis is probably just an educated guess informed by current cost data from parts suppliers. But that said, Apple has a history of aggressively buying parts to achieve a market advantage. For example, Apple paid $1.25 billion in 2005 to guarantee flash memory for iPods through 2008; that purchase made it nearly impossible for other flash music players to have competitive supplies and profit margins. Apple reportedly negotiated another similar deal in 2007. In my opinion, the Portelligent's cost is probably closer to right than wrong, simply because Apple never sells loss-leader products. And given Apple's intent to sell this phone in more than 70 countries this year, it undoubtedly worked hard to ensure low parts costs regardless of significant currency fluctuations too. So what's the takeaway here? It's simple: Apple's 3G phone isn't a loss-leader product needing subsidies to survivie. It's designed to be an Anywhere phone that puts your online life, media, and connections in your pocket, yet be simple enough for your grandma to use. But for Apple, it's a business platform designed to make money -- and the details of that business design may surprise more analysts than the product itself.

Posted by

Carl Howe

at

2:49 PM

2

comments

![]()

![]()

Labels:

Apple,

carriers,

iPhone,

iPhone 3G,

iPods,

loss-leaders,

subsidies

Tuesday, June 10, 2008

Seven Overlooked iPhone 3G Details

The blogging world is abuzz at Apple's new $199 iPhone 3G, with most writers (including Yankee Group) bemoaning the lack of surprises in Steve Jobs Keynote. But my analysis of the press releases that came out after the event actually produced more surprises than I would have expected, including:

The blogging world is abuzz at Apple's new $199 iPhone 3G, with most writers (including Yankee Group) bemoaning the lack of surprises in Steve Jobs Keynote. But my analysis of the press releases that came out after the event actually produced more surprises than I would have expected, including:

- More upfront payments to Apple in exchange for no subscription payments. Based on data released by ATT, Apple will no longer receive a cut in carrier subscription revenue for iPhone 3Gs. For first generation iPhones, that amounted to $10 per iPhone per month, or about $240 over the 2-year contract. Instead, ATT is subsidizing iPhone purchases, presumably paying Apple about the same amount on the day of purchase. So who cares? Well, Apple and ATT investors do: despite charging $10 more per month for the iPhone 3G data service, ATT will take a hit of about $600 million annually over the next two years, all of which presumably will show up on Apple's balance sheet due to subsidies. Note carefully: this does NOT mean that Apple is discontinuing its accounting for iPhone sales prices over 24 months -- it simply means that it isn't getting monthly payments from the carriers for iPhone 3Gs. By the way, the original iPhone subscription payments will continue for the full two years.

- In-store activation required in the US. Apple pioneered do-it-yourself phone provisioning through iTunes last year. Sadly, ATT has forced Apple to drop this unique feature, now requiring in-store activation of the phone, presumably to ensure that it earns back its iPhone subsidies from subscriptions. This has two significant implications: 1) Apple can no longer sell its phone online through the Apple Store, and 2) anyone waiting in line on July 11 for a phone should expect to wait hours longer as people buying phones each wait 10-12 minutes for in-store activation. This is one of the rare circumstance where Apple has decided to degrade the customer experience to please its carrier partners.

- Multiple carriers in some countries. As Apple pushes forward to deliver the iPhone is 72 countries, it seems to have gotten overly enthusiastic in countries like Portugal, Austria, Switzerland, Italy, and Australia, each of which has gotten not one, but two carriers offering the iPhone. So much for exclusive carrier deals.

- iPod touch is poised for a price cut. With the iPhone cut to $199, iPod touches selling for $299, $399, and $499 seem out of place. While there's no similar carrier subsidy to reduce these prices, Apple's not dumb enough to leave them there. Expect a $100 price cut on these products before the back-to-school season.

- Apple's toe dip into running an iPhone NOC. This was a real sleeper, but an important one for developers. Apple has refused to allow developers to run background applications on the iPhone (understandable given power and stability requirements). Instead, Apple is providing a centralized push application service that can present badges, sounds, and text alerts on any number of phones at the same time. What Apple has actually created here is a poor man's Blackberry Enterprise Server and Network Operations Center, complete with the associated single point of failure too. It's too early to know how much developers will embrace this service, but it in essence makes the iPhone a cloud computing client.

- Multi-mode location-based services. Yes, Virginia, the iPhone does support both GPS and photo geotagging. But the dirty secret of GPS is that it doesn't work in the most common places you use your phone -- inside and in the shadows of buildings in cities. But just as the navigations systems built into cars do, the iPhone integrates multiple sources of location information -- cell tower triangulation, WiFi network triangulation, and GPS -- into its location service. The result: the iPhone's location services may actually be better and more reliable than those you get from your average Garmin or Tom-Tom personal navigation system, simply because it will work in more places.

Posted by

Carl Howe

at

11:25 AM

3

comments

![]()

![]()

Labels:

activation,

Apple,

ATT,

GPS,

iPhone,

iPod,

keynote,

Steve jobs

Wednesday, May 7, 2008

Apple links higher prices with higher sales

Today's Note From Anywhere is inspired mostly by the Green Monster sign outside our office noting the opening of the world's largest Apple Store here in Boston next week.

Elementary economics says that you build volume by cutting prices on products. But Apple's latest 10-Q filing, where it provided details of its latest record-breaking sales quarter, has a nice counterexample to that so-called wisdom. You have to dig a bit to find it, but look for page 23 of the 10-Q, which has a table titled "Net Sales". But if you don't want to look at the original, here are the lines that are of interest:

| Three months ended 3/31/2008 | Three months ended 3/31/2007 | Change | |

| Net Sales By Product | |||

| Desktops | $1,352 | $914 | 48% |

| Portables | $2,142 | $1,354 | 58% |

| Unit Sales By Product | |||

| Desktops | 856 | 626 | 37% |

| Portables | 1,433 | 891 | 61% |

| Net Sales Per Mac Sold | |||

| $1,526 | $1,495 | 2% | |

So let's walk through this line by line. Between 2007 and 2008, desktop Mac revenues increased 48% while portable Mac revenues increased 58%. At the same time, desktop units sold increased 37%, while portable unit sales went up 61%. And the average net sale per Mac? Despite the fact that Apple was selling many more desktops and notebooks, the average net dollar amount sold per Mac increased 2%. Said another way, despite the fact that consumers paid 2% more per unit, consumers bought nearly 50% more Macs year over year.

Now the sharp-witted readers will note that this increase in average selling price can be explained nicely by the fact that Apple sold more notebooks than desktops. Since notebook computers have slightly higher selling prices, that change in product mix almost entirely accounts for the increase. But even so, average selling prices for desktops went up year over year, not down. And if you look at the original 10-Q filing, you'll note that average net sales for iPods went up as well, almost certainly driven by iPod touch sales.

So what's the takeaway here? It's that innovation and marketing -- creating unique products that customers want -- trump price elasticity with consumers. The elementary economic wisdom that you increase volume by cutting prices assumes that you are selling a commodity. Apple isn't selling commodities; it is selling differentiated products that only it makes. And that means that Apple's economic model is one that is anything but elementary.

Posted by

Carl Howe

at

9:01 AM

6

comments

![]()

![]()

Wednesday, April 23, 2008

Apple posts another record quarter -- and it isn't even the holidays

Apple really has been on a tear lately, and I'm not just saying that because I got a new MacBook Pro for a great price. Apple just reported another record quarter of sales, including 2.3 million Macs, 1.7 million iPhones, and more than 10 million iPods. They reported more than $1 billion in profit for the quarter, but added nearly $4 billion in cash to its war chest.

Not everyone may be thinking this way, but to me, this all just shows how well a company can do when they go past selling hardware or software, and start selling Anywhere experiences.

Wednesday, March 26, 2008

Fun drives iPhone inevitability?

I found that this article by Matt Asay on CNET.com that claims The inevitability of the iPhone struck a chord with me. Specifically:

The iPhone "just works," and then some. I thought I wouldn't be able to type on the iPhone without tactile feedback. I was wrong. I'm actually faster on the iPhone than I ever was on the Blackberry, and that's with only an hour of "training." I thought I would miss a host of things with my Blackberry, but I haven't. Instead, I've been blown away by the innovative use of gestures and the user interface. I resisted the iPhone for a year or so, but looking back it was inevitable that I'd end here. It is the best-designed phone that I've ever seen or used.

As someone who is carrying both a Blackberry and an iPhone with him nowadays, I'm struck by how different the two experiences are. Not surprisingly, when I use the Blackberry, it feels like work; when I use the iPhone, it's fun. We'll see if that persists when the iPhone grows enterprise email access, but I suspect it will. After all, what good is an Anywhere device if you avoid using it because it feels too much like work?

Posted by

Carl Howe

at

9:27 AM

1 comments

![]()

![]()

Labels:

Apple,

Blackberry,

iPhone

Tuesday, March 18, 2008

How the iPhone SDK is reshaping mobile application development

Eugene Signorini, Andrew Jaquith, and I wrote a Yankee Group Decision Note analyzing the Apple iPhone Software Development Kit (SDK) announcement last week; clients will probably see it in our published research sometime next week. But despite that note being more than 2,000 words, I'm still finding new insights from other writers on the topic. Today's harvest includes some commentary from Michael Mace, who declares that Apple gets it right. Michael's been on my mobile Web Sites interview list because he's an authority on many aspects of the mobile market and business strategy, and I think his comments on the intersection of mobile apps and the iPhone are particularly interesting:

I think it's likely that web apps will eventually displace most native mobile apps, because the addressable market will be so much larger. But eventually can take a long time, and if anyone can buck the trend it'll be Apple. They have created by far the best overall proposition for mobile developers on any platform in the US or Europe, and I hope they'll do very well for a long time.

Apple is challenging the rest of the mobile industry to compete on its terms. It will be very interesting to see how the other mobile vendors react, Nokia and Microsoft in particular. Nokia seems to be focused on a strategic positioning activity around seeing who can collect the most runtimes, while Apple is solving real developer and user problems. It's a striking contrast.

Posted by

Carl Howe

at

1:05 PM

0

comments

![]()

![]()

Labels:

Anywhere Web,

Apple,

iPhone,

Mobile Web,

Yankee Group

Friday, March 7, 2008

Did the iPhone SDK mean Apple will corner the Anywhere device market?

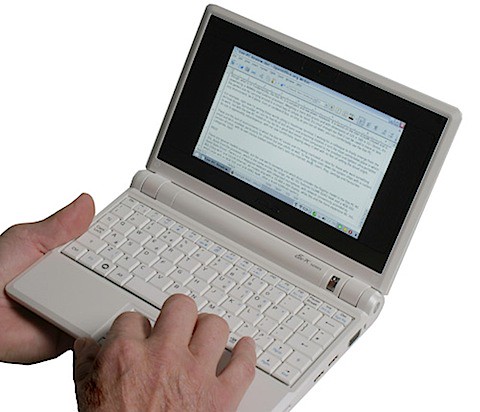

GottaBeMobile.com has an interesting claim that Apple's SDK announcement yesterday may have an unexpected result:

Apple opened a big door with the announcement and shut quite a few others in the process. Apple not only took the UMPC/MID market away, it will own mobile for some time to come, with everyone else playing catch up. The race to the top is over. Now everyone else can scramble to figure out who is number two.

[From GottaBeMobile.com]

So here's how I'm going to gauge whether this is happening or not: track the sales of Asus Eee PC at Amazon. If they fall off a cliff, Apple killed the segment. But given the incredible diversity of developers and users, some of whom have not interest in iPhones or Apple, I suspect they'll do just fine. The key to thinking about Anywhere products is that people have many different requirements for how they will use and buy mobile devices. No one company can meet all those needs, no matter how wonderful the device.

Of course, that doesn't mean that Apple won't make a whole lot of money trying.

Thursday, March 6, 2008

Apple knows how to launch a platform

I'm in the midst of writing an analysis piece for Yankee about what Apple's announcement of its iPhone Software Development Kit means for enterprises. But here's the short version:

Apple just showed everyone how to grow a developer ecosystem.

Apple kicked off the announcement by giving enterprises features they had requested to approve iPhone uses in business, including:

- Microsoft ActiveSync built in for secure push email and remote wipe and Exchange integration,

- 802.1x and WPA2 WiFi security,

- Cisco VPN support for secure communication

But then Apple kicked things up a notch with the SDK details, which included:

- Complete integration with Apple's existing developer framework, Xcode,

- Performance analysis tools to make apps run fast on the iPhone

- Access to nearly every API on the device, including OpenGL, multi-touch, WiFi, accelerometers

- A full iPhone simulator to help with debugging.

Just to prove this wasn't hype, Apple gave the SDK to a group of companies for about two weeks to see what they could do with it. Each of those companies created versions of their applications in that time, including Electronic Arts' Spore, Salesforce's Salesforce Automation Epocrates's instant messenger, Epocrates' Drug Identifier, and Sega's Super Monkey Ball. Not bad for two weeks of work.

But the real surprise was Apple's efforts to market and develop an ecosystem for third-party iPhone development. Marketing and distribution terms were:

- All third-party applications will be distributed through a new iPhone AppStore. Developers wishing to do so pay a $99 fee, but can set their own prices for their apps, including free should they choose to do so.

- iTunes will have a part of its store dedicated to third-party apps and promoting the top downloads. Developers get 70% of revenues for paid apps.

- Kleiner Perkins is launching a $100 million iFund to fund iPhone developer companies. That means money shouldn't be a barrier to getting an great third-party iPhone software business off the ground.

Now I know that not everyone will agree with all the details, and I think everyone expected Apple to seed iPhone development with its SDK. But what Apple actually did is till the ground for development with enterprise features, seed it with the SDK, water it with marketing and distribution, and fertilize it with cash. If third-party apps don't grow with that kind of support, nothing will.

Posted by

Carl Howe

at

5:11 PM

7

comments

![]()

![]()

Labels:

Apple,

iPhone,

Mobile phones,

SDK

Monday, March 3, 2008

Anywhere apps get a choice of development tools

Today, I'm thinking about two news items this week as I am researching mobile Web site development for my upcoming report:

- The Apple announcement that it will release its iPhone SDK and roadmap on March 6, and

- A blog post by Michael Mace writing the obituary of native mobile phone apps called Mobile applications, RIP

These two news items reflect the two camps I've talked to about Mobile Web sites. One camp believes that native mobile applications are the only way to get the responsiveness and integration needed for a great mobile experience. In the other camp, though, are a large group of people who believe that the mobile Web will evolve to capture the lion's share of mobile user attention, just as it has on the desktop.

Just like with desktop and laptop computers, I don't think mobile app development will ever be a completely "either-or" proposition; I think we'll see Web AND native app development. For example, if you want to edit photos you've loaded on our laptop, you can edit them either using a desktop app like iPhoto or Photoshop (assuming you have them installed), or you can edit them online using Snipshot.com, Picnik.com, fotoflexer.com and a host of others (assuming you have enough online access available). So why would we expect Anywhere mobile applications to be any different? Some applications will require dedicated native software, others will make more sense on the Web. Both approaches work.

Of course, Apple has already figured this out. Last year, it touted using Web technology to develop iPhone apps. This year, they're announcing the native iPhone SDK. Developers will get to choose which approach meets their customers' Anywhere needs best. The open question is which approach will generate the most excitement and enthusiasm for the platform. And while native apps have always held the edge in prior platforms like Palm and RIM devices, those platforms didn't boast browsers that were as a capable as the iPhone's. Only time will tell which tools developers will choose as their favorites, but at least developers will have the choice.

Posted by

Carl Howe

at

1:58 PM

0

comments

![]()

![]()

Labels:

Apple,

Application development,

iPhone,

Mobile Web,

SDK

Thursday, February 28, 2008

Apple's Anywhere iPhone

Apple's invitations to an event on March 6 to discuss the Apple Software Development Kit for the iPhone generated several Apple inquiries around here, and Apple COO Tim Cook's talk yesterday at the Goldman Sachs event added more fuel to the story. I thought I'd take a break from my usual "Anywhere all the time" writing, and just pass on some of the data and answers I've been providing to reporters.

- Has the iPhone wave peaked? No; in fact, I would argue that the iPhone phenomenon has just gotten started. The Apple iPhone is truly an Anywhere phone, putting communication, media, and Internet content in the palm of nearly anyone's hand anywhere in the world and on (mostly) any GSM network. Despite the iPhone only being available for sale in four countries, it's being used today in more than 100. This adoption is amazing because no official native third-party apps have been released and the device is a version 1.0 device, Apple's first effort in a market most pundits said it could never succeed in. Imagine what sales will look like when there are official distribution channels in more than four countries, when third party developers can create new iPhone applications, and when Apple has version 2.0 and 3.0 devices in the market.

- Are iPhone unlockers hurting Apple? I think this idea is way overblown. Apple receives full retail price and full retail profits for every phone it sells, locked or unlocked. The device is profitable by itself, regardless of whether it gets carrier revenue sharing or not. Further, the fact that Apple is doing carrier exclusive deals now doesn't mean it is wedded to that model, a point Tim Cook made in his presentation. So everyone who is claiming Apple is "losing" $1 billion due to unlocked phones is simply noting problems with their own models of Apple's business, not Apple's. Apple of course doesn't acknowledge or report any revenues from carriers associated with the iPhones, so any numbers or losses you hear about those are inferred speculation, not facts.

- Does Apple need to cut prices on its Iphone? Not in the least. Apple has no intent of chasing Motorola to see who can lose more money on phones in a futile attempt to gain market share. Market share isn't the name of Apple's game; consistent and growing profits are. Apple's brand says to nearly everyone in the world that its products are fashionable, easy-to-use, and a bit exclusive. Apple competing only on price would be like BMW cutting prices on its cars so they can be distributed through Wal-Mart; it would be marketing suicide.

In my opinion, Apple's game plan on its Anywhere phone will likely mirror that of iPods. iPods started with one model and then gradually branched out to three or four of them (depending on whether you consider the iPod touch to be an iPod or a low-end iPhone). Even today, the 16 GByte iPod touch sells for the same price as the original iPod introduced in 2001. People should expect there to be both cheaper and more expensive iPhones over time, but that the target price points for the iPhone with touch screens and Internet capabilities will remain what they are today. - Is Apple going to make its iPhone goal of 10 million phones by the end of 2008? Yes. Apple doesn't provide goals if it doesn't think it can both make and exceed them. While the economy and consumer spending are throwing up some roadblocks, I see Apple easily exceeding that goal by about 25% by the end of calendar 2008. And in case anyone was confused, that's the benchmark that Steve Jobs set: 10 million phones by the end of 2008, not 10 million phones in the first year of sales or the first fiscal year.

Posted by

Carl Howe

at

9:44 AM

3

comments

![]()

![]()

Labels:

Anywhere,

Apple,

iPhone,

Mobile phones

Monday, February 11, 2008

Imagine if you didn't hate your mobile carrier

CNBC today kicked off its coverage of the World Mobile Congress today with an article titled, The Mobile Industry Has an Innovation Emergency.". I have to say, I agree with CNBC's point of view that many players in the mobile industry are stuck not knowing how to innovate. But after fighting with making mobile calls from my office in downtown Boston the last week or so, I have a dream that I think would challenge today's mobile carriers in their quest to become Anywhere providers:

Imagine if our mobile phone carriers actually tried to exceed our expectations?

Today, we tend to give mobile phone carriers accolades for just doing their jobs some of the time, like placing phone calls and delivering text messages. I've been trying to place and receive mobile phone calls from my office in downtown Boston over the past few weeks, and despite having a contract with the largest mobile phone company in the US, my success rate is about 75%. Said another way, my carrier doesn't deliver the service I pay for 25% of the time. Not exactly the poster child for world-class service, is it?

Imagine what would happen if they not only delivered service 100% of the time, but actually made it a fantastic experience?

Truth be told, dealing with any mobile carrier today is about as much fun as a root canal. Assuming you can actually make a call (see paragraph 2 above), calling to complain doesn't help. The carriers may claim that our phone call to complain is important to them, but that doesn't provide any salvation from their hell of automated phone trees. I'm happy to key in my phone number to allow them to access my records, but having to repeat that number verbally with the customer service rep after I've done it online just adds insult to injury. And the fact that I have to do that every time I get handed off to another representative just reinforces the impression that my business just doesn't matter to the people running these carriers.

Am I a dreamer to expect anything better? Perhaps. But there's data that suggests that if a new entrant delighted customers, the old guard of mobile phone companies could see serious trouble. The data I'm referring to comes from a study that Changewave released this week about the iPhone.

According to Changewave Research, Apple's iPhone has become the most popular choice for consumers planning to replace their mobile phone, which you can see below

Why? Here's a pretty good reason: 72% of iPhone customers are "very satisfied" with their phones, compared with only 55% for RIM customers, and even lower results for all the other manufacturers. Here's ChangeWave's chart for that result.

This data would be impressive for any manufacturer. But the really key point here is that the iPhone is made by a company that wasn't even in the mobile phone business a year ago. Further, Apple completely ignored the requirements of old-guard carriers; instead, it insisted that carriers do things that would help consumers, like instituting unlimited data plans and visual voice mail for the iPhone. It focused on delighting the customer, not perpetuating same old way of doing business.

Now I know that very high barriers such as spectrum rights and infrastructure costs block new carriers from entering the mobile phone business. Yet every successful new business overcomes some sort of obstacle that previously seemed insurmountable; after all, FedEx's overnight delivery business model was panned as impractical when the US Postal Service had a near monopoly on package delivery. And what better recipe exists for success than millions of unsatisfied customers willing to pay a monthly fee for a better service?

I don't know if there's a Steve Jobs, a Fred Smith, or a Herb Kellaher (Southwest Airlines) out there thinking about creating a great mobile phone business. But imagine if consumers were so excited about a mobile carrier that they'd line up for days to sign up for their service, like they do at the Apple Stores today. Imagine if that carrier guaranteed your satisfaction with their service or your money back. Imagine if that carrier had only a few, simple to understand services that took a few clicks to sign up for and another few clicks to get rid of if you didn't like them. And imagine if that carrier actually had customer service people who had both the power and authority to turn dissatisfied customers into satisfied ones.

I don't think Steve Jobs, Fred Smith, or Herb Kellaher have any plans to get into the carrier business. But I can dream, can't I?

Posted by

Carl Howe

at

2:39 PM

1 comments

![]()

![]()

Labels:

Apple,

Changewave Research,

Fedex,

Innovation,

iPhone,

Mobile phones

Wednesday, February 6, 2008

Nüvifone: Garmin's products are not just for navigation any more

I've been meaning to write for a while now about Garmin's new iPhone competitor, the nuvifone. Gizmodo reminded me about that today by posting the above Garmin marketing video.

The video tries to show how hip and cool is could be to combine navigation and communication in one device without the panache of the iPhone commercials. As concept ads go, it's really not bad. While they try to hit far too many points in a single video (tip to Garmin: next time try making a single point in each video. See the iPhone ads for examples), Garmin is actually emphasizing user benefits instead of just features in their marketing. Garmin gets it; consumers have to be excited about the device for it to succeed.

But I find myself agreeing with John Gruber who noted the sniff of vapor in Garmin's Web marketing materials. The screen shots in the nuviphone media gallery sport far more PhotoShop skill than anything real, since I find it unlikely the nuviphone is going to sport a 793x1400 pixel screen. And unlike the iPhone, no one has actually seen one of these devices in operation. I'm hoping some of my colleagues will see one at 3GSM in Barcelona next week, but I'm willing to bet Garmin will be showing mockups instead of operating phones behind glass as Apple did at its January 2007 launch.

But all that said, I have to agree with one of the commenters on Gizmodo: isn't it interesting that significant mobile device innovation is coming from manufacturers who aren't traditional cell phone makers?

Posted by

Carl Howe

at

9:12 AM

0

comments

![]()

![]()

Labels:

Apple,

GPS,

iPhone,

Mobile phones,

Mobility,

Navigation

Tuesday, February 5, 2008

Apple and Opera give the mobile Web experience a boost

My iPhone and I have become inseparable as I wander around the Anywhere world. Well, today, Apple decided to up the iPhone ante by introducing $499 16 GByte iPhones and 32 Gbyte iPod touches. Add to that the fact that Opera Software ASA has just started previewing its new Opera Mobile 9.5 Web browser in time for the 3GSM conference in Barcelona next week, and we can see that the lines between the mobile Web and the desktop Web are starting to blur. Not so coincidentally, that's one of the themes of the research I'll be doing over the next year at Yankee Group. My sense is that it's going to become a hot and controversial topic.

Posted by

Carl Howe

at

11:11 AM

0

comments

![]()

![]()

Labels:

3GSM,

Apple,

iPhone,

Mobile Web,

Opera